UX Maturity Report

Executive Summary

Key Insights

- Market Leader: Amazon UK leads with 7.8/10

- Most Consistent: Chewy shows the most balanced performance

- Industry Strength: Quantity Selection & Editing (avg: 7.9/10)

- Market Vulnerability: Subscription & Auto-Delivery Options (avg: 2.6/10) - opportunity to differentiate

Strategic Insights

Market Leaders

- Amazon UK (7.8/10) - Basket Summary & Total Clarity

- Chewy (7.8/10) - Subscription & Auto-Delivery Options

- Pet Supermarket (7.8/10) - Shipping Cost & Free Delivery Threshold

Top Opportunities

- Subscription & Auto-Delivery Options - 69% score below 6 Potential: +5.4pts vs avg competitor

- Express Checkout Options - 62% score below 6 Potential: +4.0pts vs avg competitor

- Delivery Timing & Urgency - 62% score below 6 Potential: +3.0pts vs avg competitor

Competitive Threats

- No standout threats identified (no competitor scoring 9+ on any criterion)

Overall Rankings

| Rank | Competitor | Overall Score | Competitive Position | Key Differentiator |

|---|---|---|---|---|

| 1 | Amazon UK | 7.8/10 | Strong Contender | Basket Summary & Total Clarity |

| 2 | Chewy | 7.8/10 | Strong Contender | Subscription & Auto-Delivery Options |

| 3 | Pet Supermarket | 7.8/10 | Strong Contender | Shipping Cost & Free Delivery Threshold |

| 4 | zooplus | 7.4/10 | Strong Contender | Subscription & Auto-Delivery Options |

| 5 | Pet Drugs Online | 7.3/10 | Strong Contender | Payment Options & Trust Signals |

| 6 | Jollyes Pets | 6.8/10 | Strong Contender | Product Details in Cart |

| 7 | petshop.co.uk | 6.8/10 | Strong Contender | Delivery Timing & Urgency |

| 8 | animed | 6.8/10 | Strong Contender | Basket Summary & Total Clarity |

| 9 | Tesco | 6.8/10 | Strong Contender | Quantity Selection & Editing |

| 10 | viovet | 6.8/10 | Strong Contender | Shipping Cost & Free Delivery Threshold |

| 11 | Lords & Labradors | 6.8/10 | Strong Contender | Express Checkout Options |

| 12 | Pets Corner | 6.8/10 | Strong Contender | Shipping Cost & Free Delivery Threshold |

| 13 | Pooch & Mutt | 6.8/10 | Strong Contender | Shipping Cost & Free Delivery Threshold |

| 14 | Petplanet | 6.8/10 | Strong Contender | Mobile Layout & Touch Usability |

| 15 | sainsburys | 5.8/10 | Competitive | Product Details in Cart |

| 16 | Morrisons | 5.2/10 | Competitive | Quantity Selection & Editing |

Filter & Search

Visual Analysis

Competitor Profiles

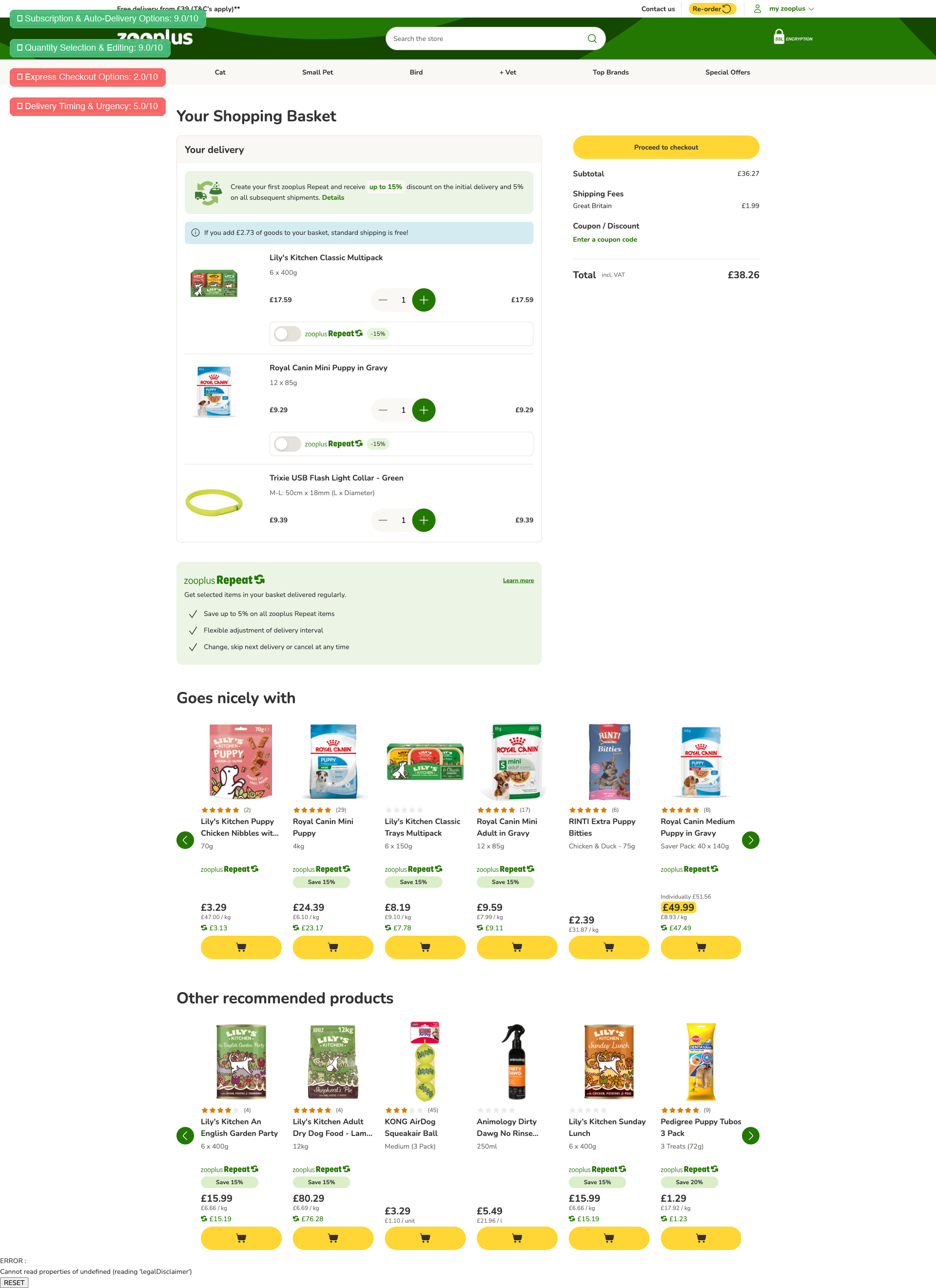

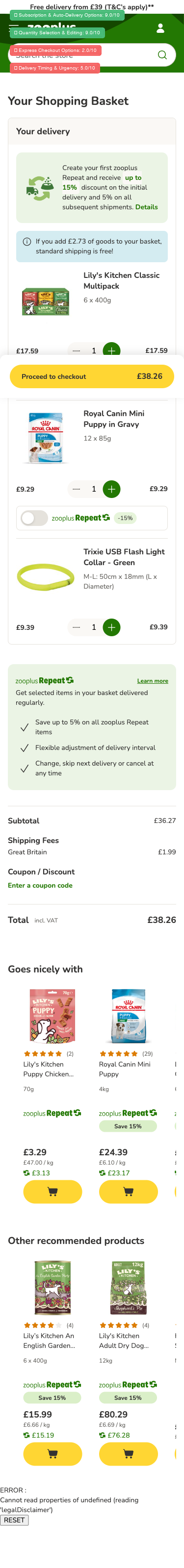

zooplus demonstrates strong subscription integration and mobile optimization, but lacks express checkout options and has limited delivery transparency—creating opportunities for competitors to differentiate on checkout friction and urgency signals.

Performance by Criteria

Competitive Advantages

- Sophisticated subscription model (zooplus Repeat) with inline toggles, prominent 15% discount messaging, and comprehensive flexibility terms creates strong competitive advantage in repeat-purchase pet food category

- Superior mobile optimization with sticky checkout CTA showing price, large touch targets, and readable text addresses 65%+ mobile traffic reality effectively

- Clear product details including pack sizes (8 x 400g, 12 x 85g) prevents confusion critical in pet food category and reduces abandonment from uncertainty

Vulnerabilities

- No express checkout options (Apple Pay, Google Pay, PayPal Express) on basket page

- Absence of delivery date estimates and urgency messaging in basket view

- Limited trust signals and no payment method icons visible on basket page

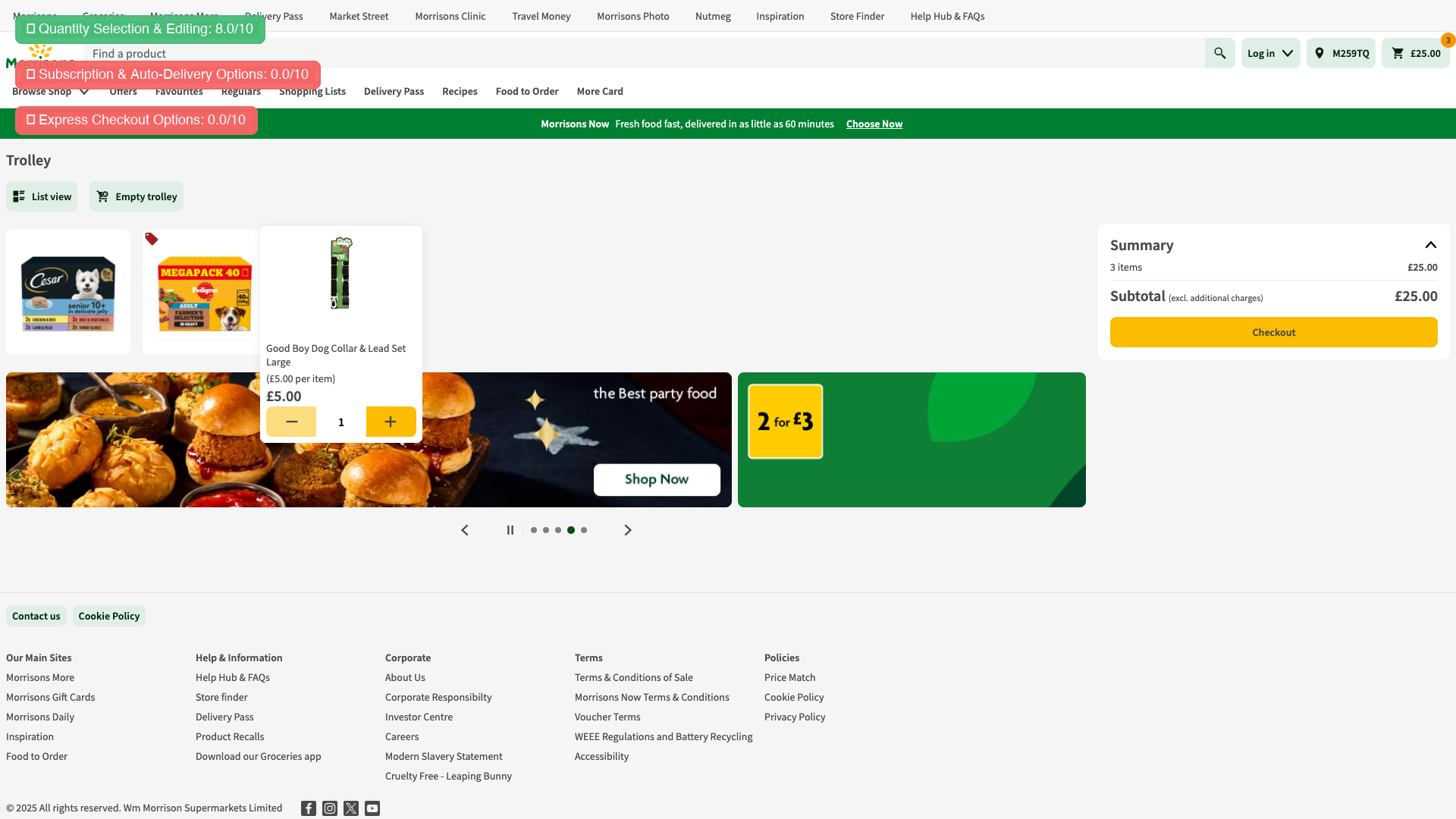

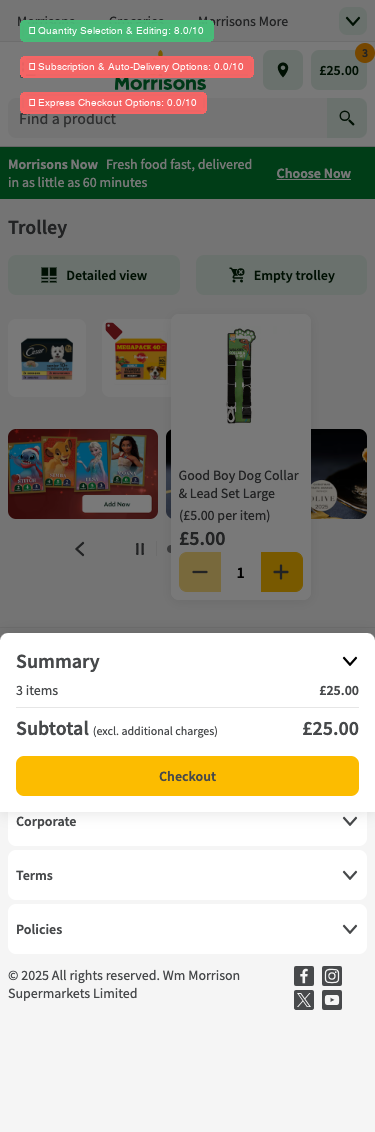

Morrisons presents a basic, functional basket experience that meets minimum requirements but lacks key competitive features for pet food retail, particularly subscription options and delivery transparency. Their implementation shows significant gaps against market leaders.

Performance by Criteria

Competitive Advantages

- Strong quantity editing implementation with prominent, touch-friendly +/- buttons that provide excellent user control

- Clean, uncluttered interface design that prevents cognitive overload and maintains focus on checkout completion

- Solid mobile responsive design with readable text, collapsible summary section, and adequate touch targets for core interactions

Vulnerabilities

- Complete absence of subscription/auto-delivery options for pet food products

- No delivery cost transparency or free shipping threshold on basket page

- Missing express checkout options (Apple Pay, Google Pay, PayPal)

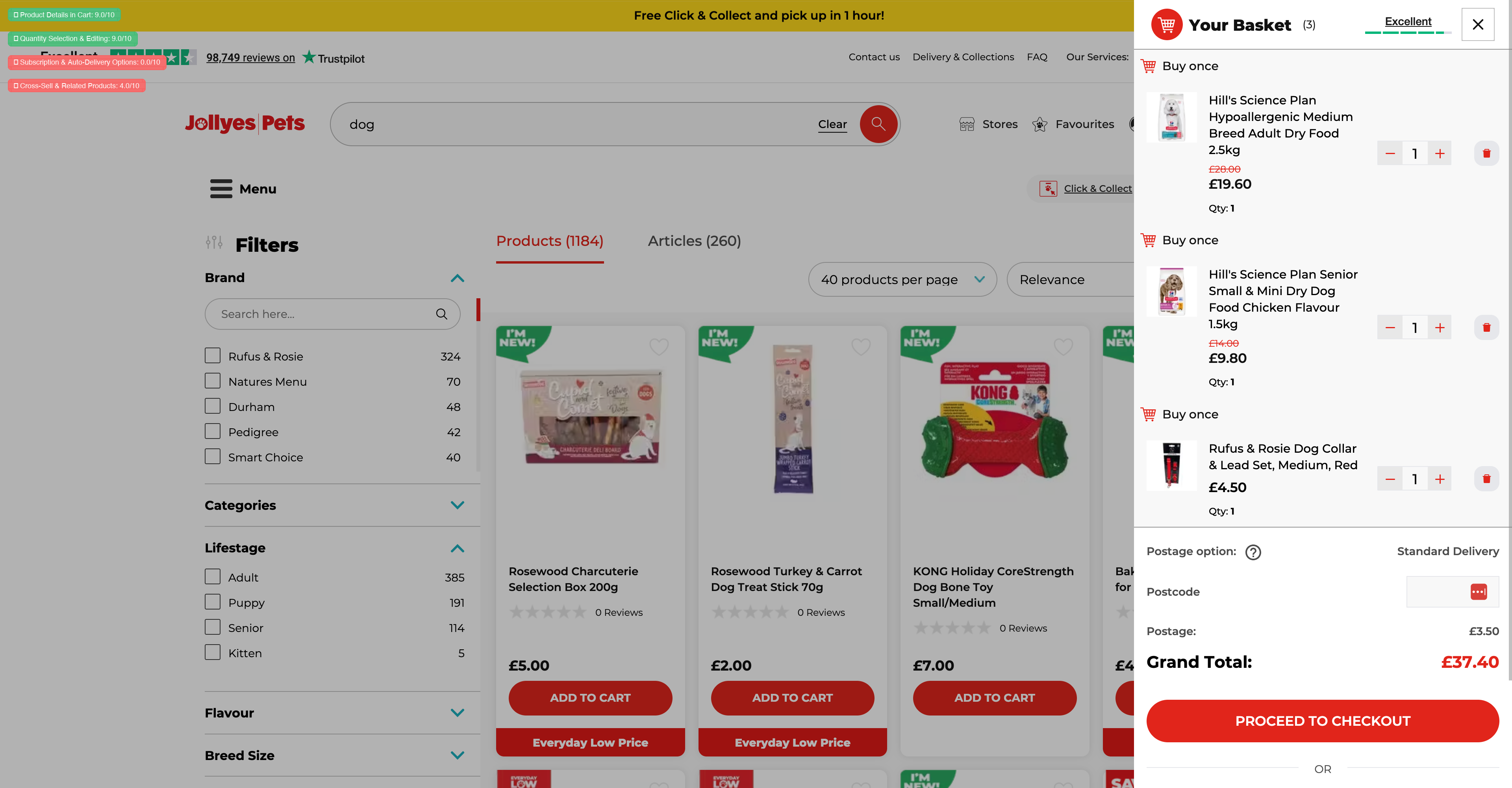

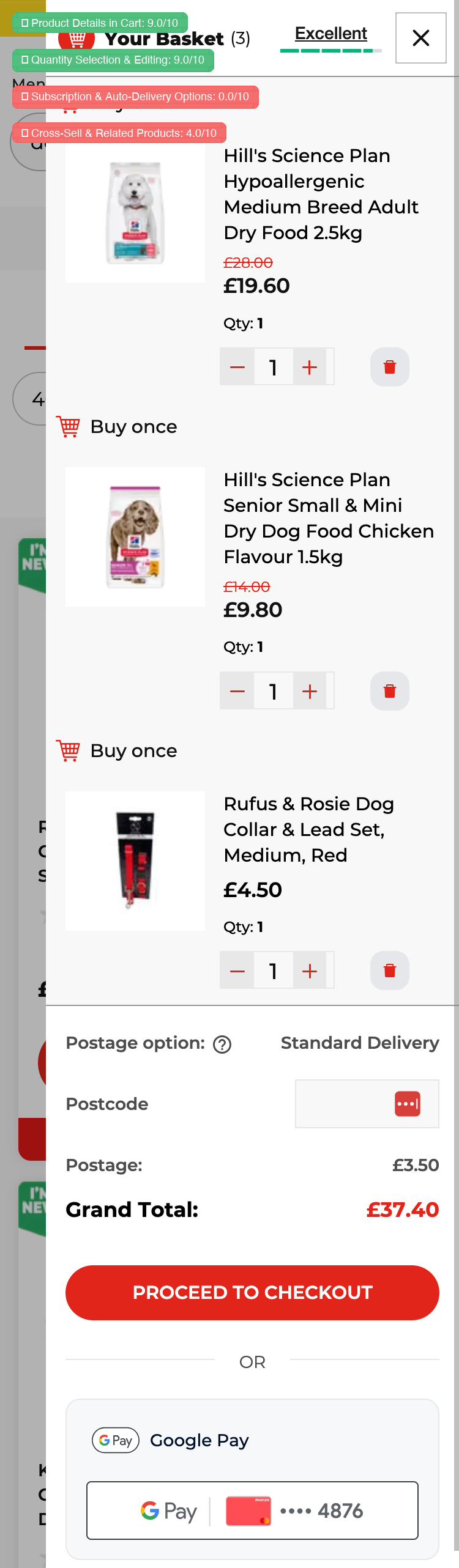

Jollyes demonstrates solid fundamentals with clear product details and decent mobile optimization, but lacks critical conversion features like subscription options and delivery cost transparency that market leaders leverage.

Performance by Criteria

Competitive Advantages

- Excellent product detail visibility in cart with clear pack sizes, life stages, and variant information that addresses pet food-specific confusion points

- Strong basket summary clarity with transparent pricing breakdown, prominent total display, and clear discount visualization

- Well-implemented quantity editing with intuitive +/- buttons and clear remove functionality that reduces friction

Vulnerabilities

- No subscription or auto-delivery program visible in basket experience

- No free delivery threshold or progress indicator shown in basket

- Minimal cross-sell recommendations in basket area

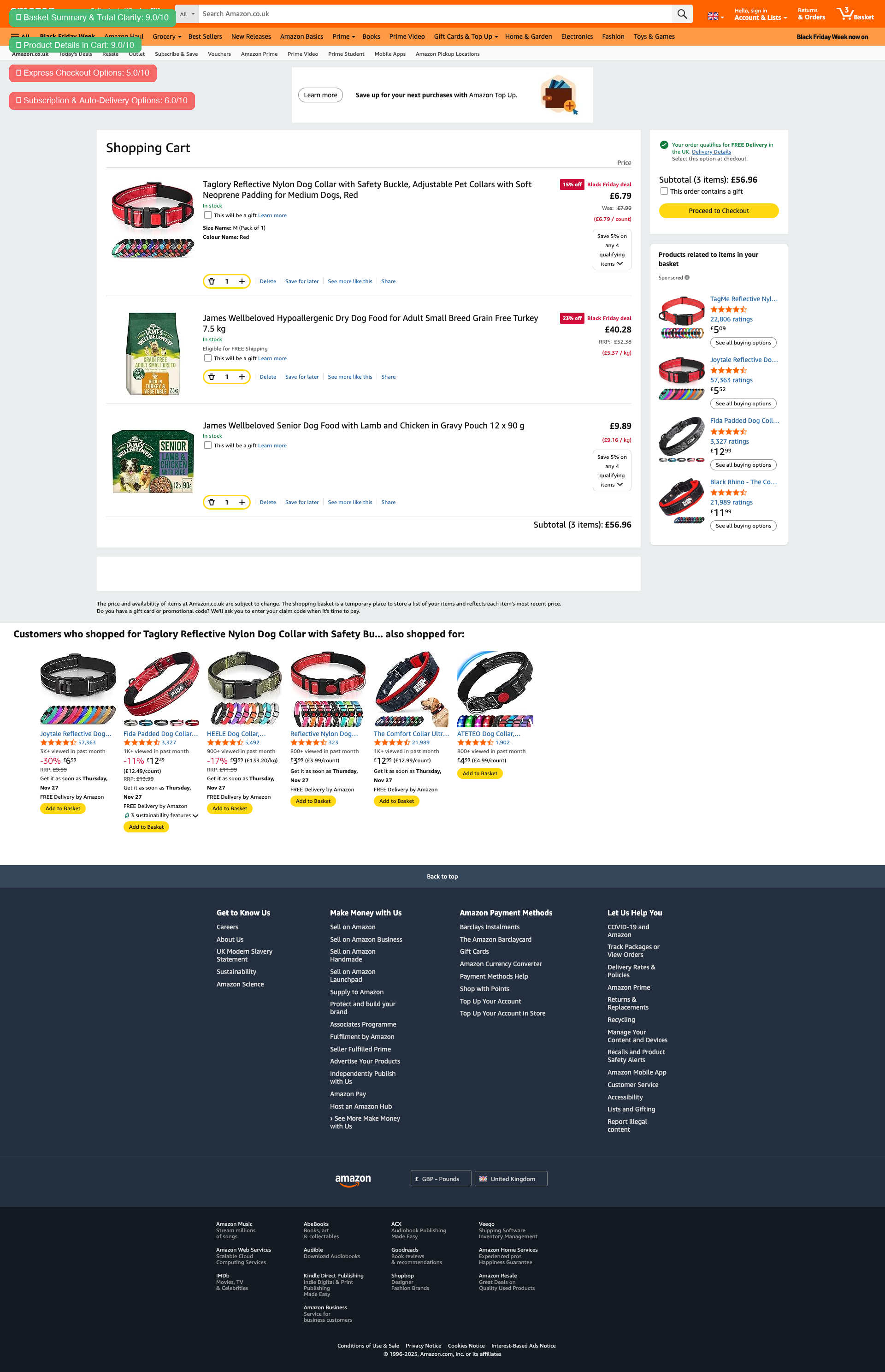

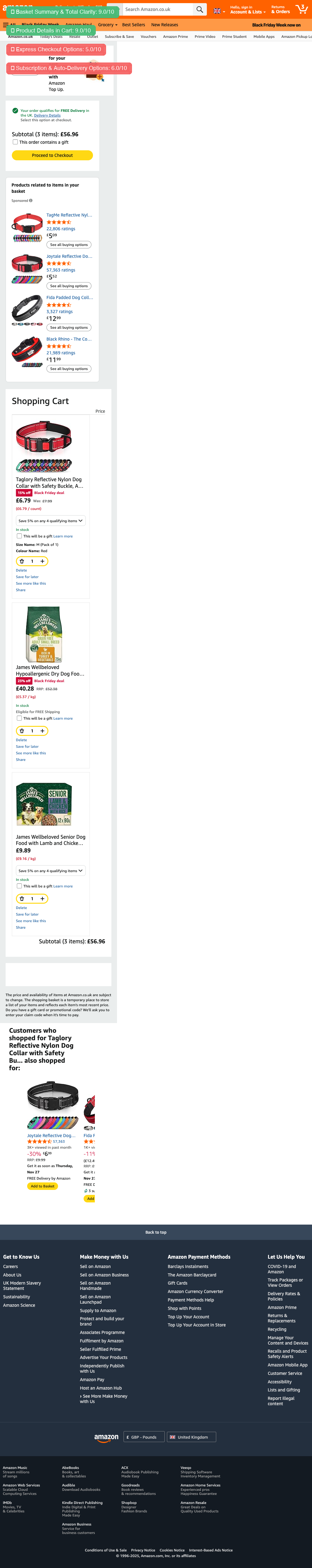

Amazon demonstrates strong baseline functionality with clear pricing and comprehensive product details, but lacks pet-specific subscription optimization and modern express checkout prominence that specialized pet retailers now offer.

Performance by Criteria

Competitive Advantages

- Exceptional product detail visibility in cart with comprehensive variant information, pack sizes, and imagery that prevents the 27% abandonment from unclear order details

- Industry-leading cross-sell recommendation engine with contextually relevant products and easy add-to-cart, driving incremental revenue (Amazon's 35% attribution benchmark)

- Clear pricing transparency with RRP comparisons, savings calculations, and prominent subtotal display that builds trust and prevents unexpected cost abandonment

Vulnerabilities

- Subscription offering is de-emphasized and lacks compelling presentation in cart view, with no clear frequency selection or savings highlight

- No express checkout buttons visible despite high UK mobile adoption of Apple Pay/Google Pay, relying entirely on traditional account-based flow

- Quantity selection uses dropdown menus requiring multiple clicks instead of intuitive +/- buttons, particularly problematic for bulk purchases common in pet food

Chewy demonstrates strong core basket functionality with excellent subscription integration and savings visibility, but lacks critical UK-specific elements like VAT transparency and suffers from suboptimal mobile layout density that could impact conversion.

Performance by Criteria

Competitive Advantages

- Industry-leading Autoship subscription integration with prominent savings messaging (5% on future orders) and flexible management, addressing the high-value repeat purchase nature of pet food category

- Comprehensive product information in cart including pack size, flavor, life stage, promotional details, and Autoship status, reducing need to navigate away and addressing the 27% who abandon due to unclear order details

- Extensive contextually-relevant cross-sell recommendations with promotional offers and easy add-to-cart functionality, approaching Amazon's 35% recommendation-driven revenue benchmark

Vulnerabilities

- Complete absence of delivery date estimates or timeframes in cart view

- Limited express checkout options (no Apple Pay, Google Pay visible in cart)

- Dropdown quantity selectors requiring multiple clicks instead of single-click +/- buttons

Sainsbury's trolley page shows fundamental weaknesses in delivery transparency and mobile optimization, with minimal integration of retention mechanisms like subscriptions that are standard in modern pet food e-commerce.

Performance by Criteria

Competitive Advantages

- Clear pack size and unit pricing display - critical for pet food category where pack sizes vary dramatically (40x100g vs single cans), reducing confusion and returns

- Functional quantity editing with large +/- buttons optimized for both desktop and mobile touch targets

- Substitute promise policy explicitly stated with refund guarantee - builds trust around stock availability concerns

Vulnerabilities

- No subscription program for pet food - treating repeat-purchase category as one-time transactions only

- Delivery costs completely hidden until checkout stage with no free shipping threshold indicator

- No express checkout options despite mobile-dominant UK market and high Apple Pay adoption

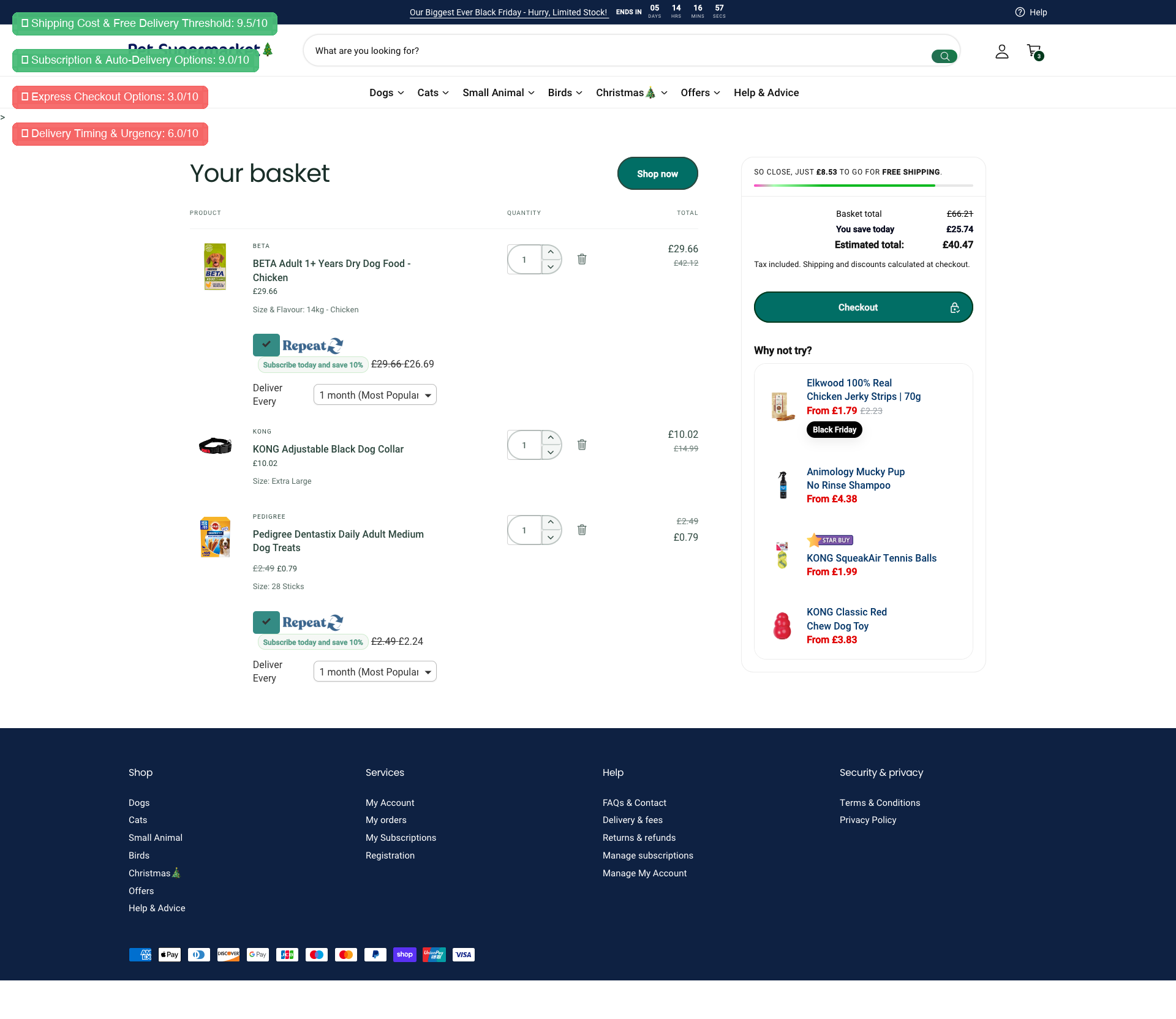

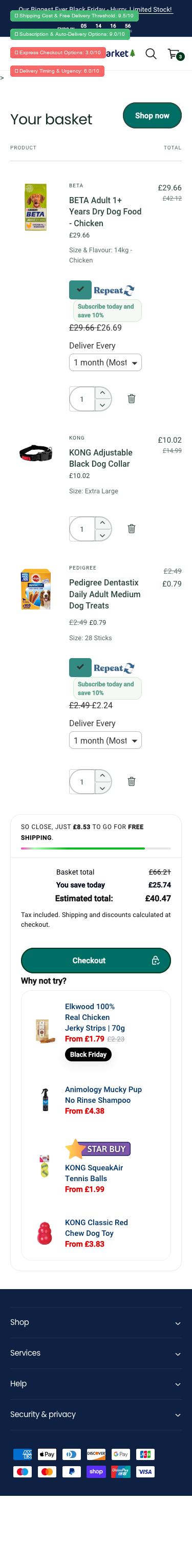

Strong subscription integration and clear pricing transparency position them competitively, but lack of express checkout and limited mobile optimization create exploitable gaps against market leaders.

Performance by Criteria

Competitive Advantages

- Exceptional free shipping threshold visibility with progress bar and clear messaging ('£8.53 TO GO') addresses primary abandonment concern proactively

- Strong subscription/repeat delivery integration with compelling value proposition (10% savings) and flexible frequency selection directly in basket

- Comprehensive quantity editing functionality with +/- buttons, remove options, and inline editing capabilities reduces friction

Vulnerabilities

- No express checkout buttons (Apple Pay, Google Pay, Shop Pay) visible in basket despite wide payment acceptance shown in footer

- Absence of delivery date estimates or next-day cutoff times - only frequency for subscriptions shown, no arrival dates for one-time purchases

- Mobile basket summary and checkout button require significant scrolling - no sticky CTA despite 65%+ mobile traffic

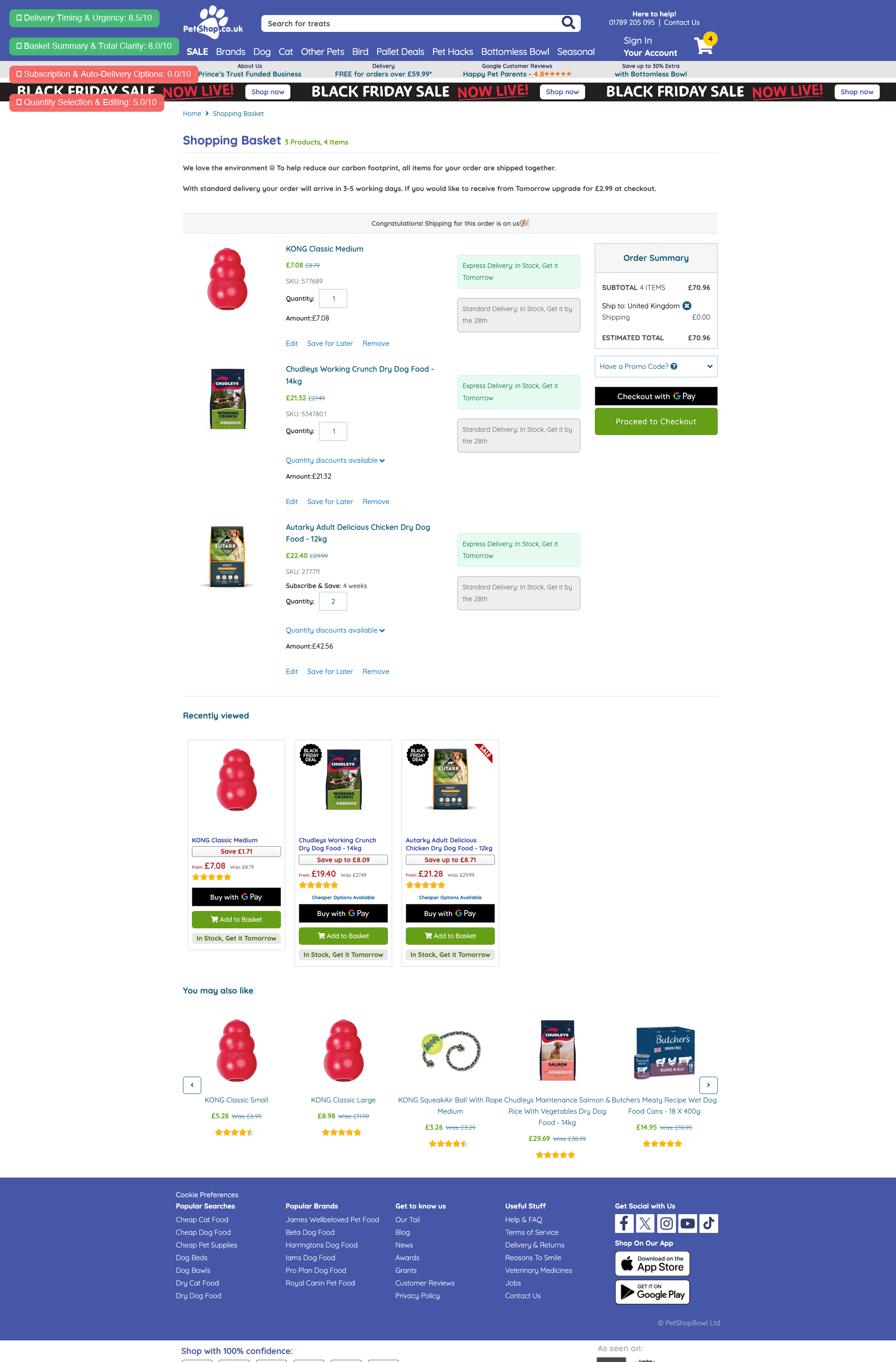

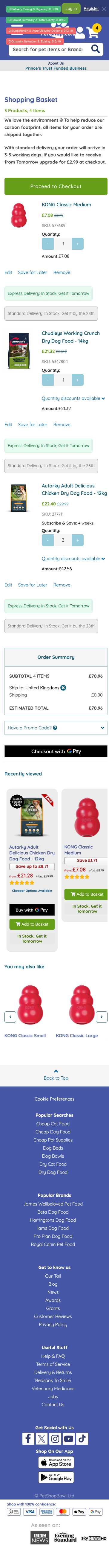

Solid execution of basket fundamentals with clear delivery messaging and express checkout, but lacks subscription/auto-delivery features which are critical for pet food retention and LTV.

Performance by Criteria

Competitive Advantages

- Clear, specific delivery timing at product level (Express: Get it Tomorrow, Standard: Get it by 28th) reduces purchase anxiety and provides certainty

- Strong cross-sell implementation with relevant recommendations and one-click add-to-basket functionality from both 'Recently Viewed' and 'You May Also Like' sections

- Clean, transparent basket summary with clear cost breakdown (subtotal, shipping, estimated total) and prominent promo code section

Vulnerabilities

- No subscription or auto-delivery option visible for pet food products in basket

- Dropdown quantity selectors instead of +/- buttons create mobile friction

- No free shipping threshold progress indicator despite free delivery program existing

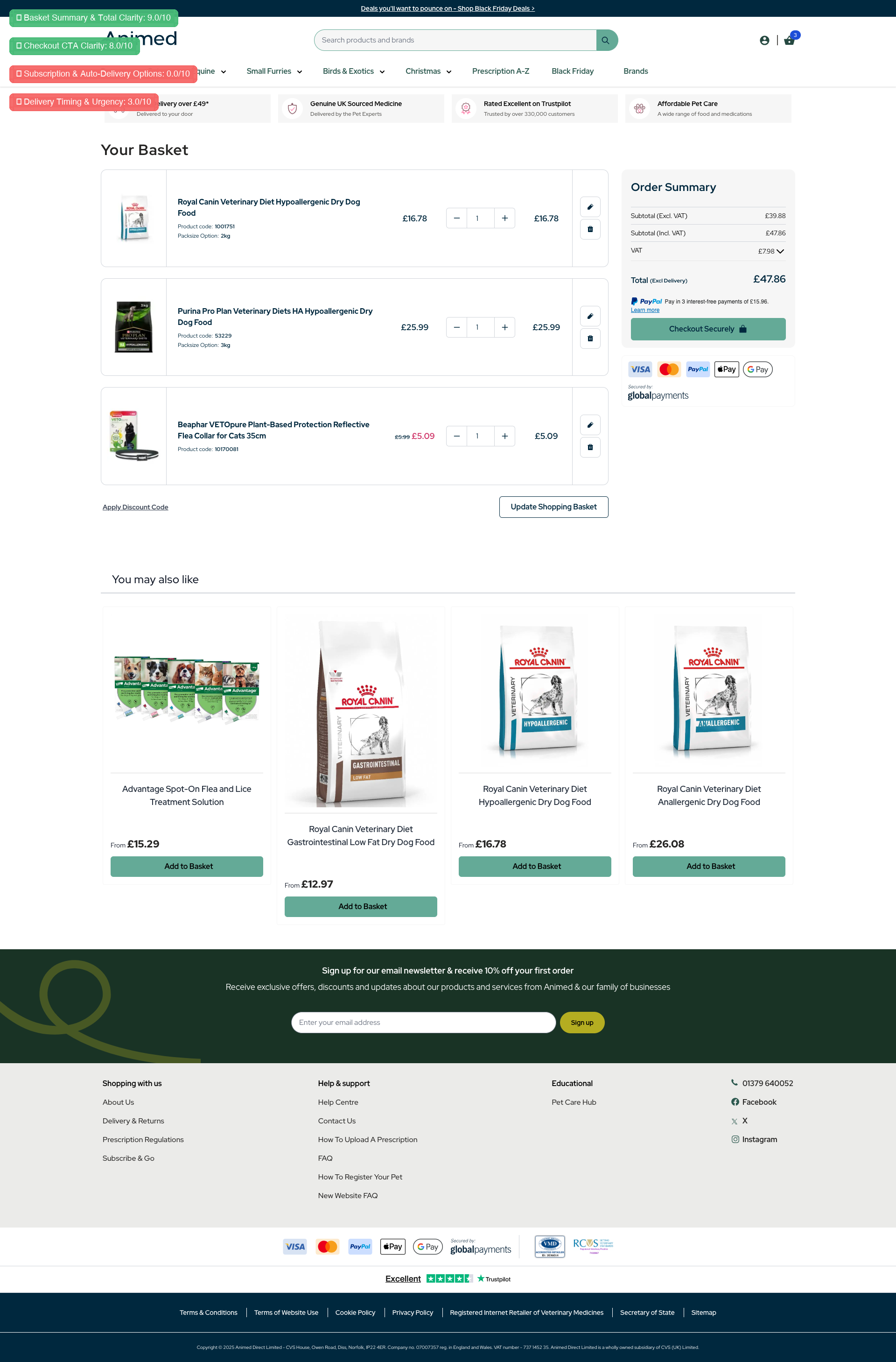

Animed demonstrates solid basket fundamentals with clear pricing and good product visibility, but lacks critical subscription/auto-delivery features and mobile optimization that market leaders leverage. They're competitive on basics but missing revenue-driving features.

Performance by Criteria

Competitive Advantages

- Exceptional cost transparency with detailed VAT breakdown and clear total display that exceeds UK retail standards

- Strong trust signal implementation including payment method diversity, Trustpilot rating, security badges, and pet medication expertise messaging

- Highly relevant contextual cross-selling with veterinary diet alternatives and complementary products (flea treatment) that genuinely enhance customer value

Vulnerabilities

- Zero subscription or auto-delivery functionality for prescription veterinary diets - products with highest repeat purchase frequency

- No delivery date estimates or dispatch cutoff times shown in basket despite selling heavy products (dog food bags) where delivery timing is critical

- Missing dynamic free delivery progress bar despite customer being £1.14 away from £49 threshold - visible basket total is £47.86

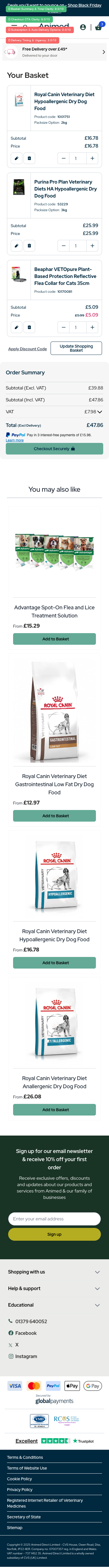

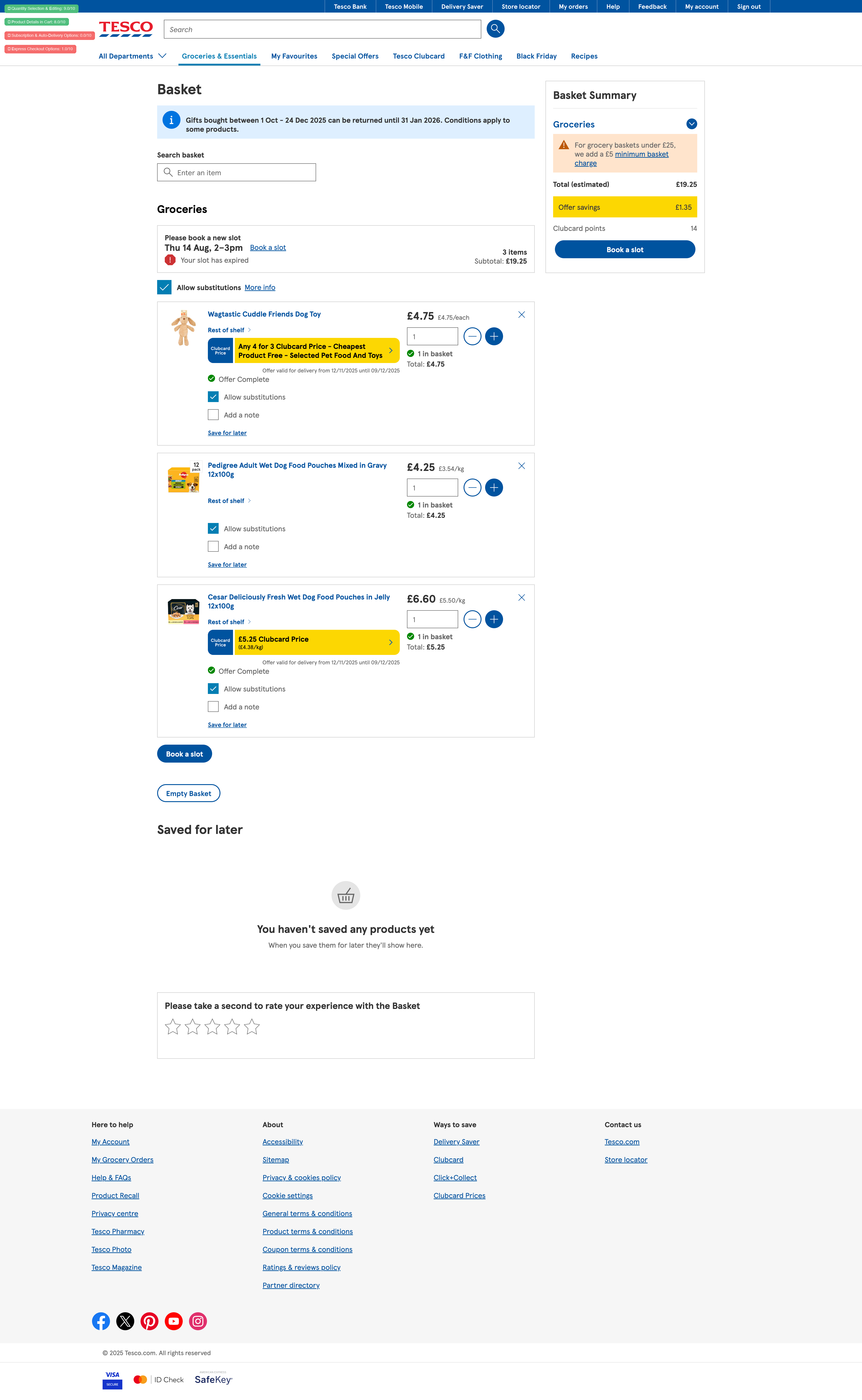

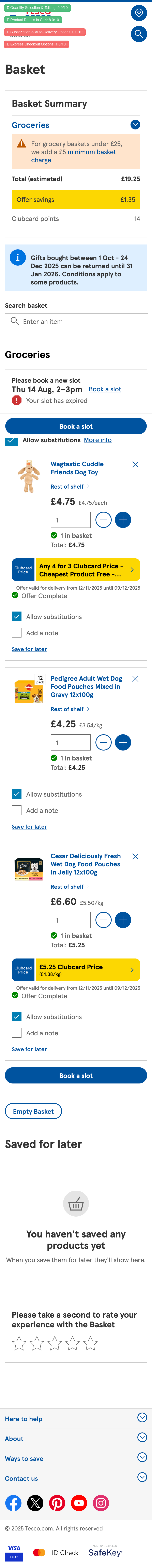

Tesco demonstrates strong fundamentals with clear delivery slot booking, Clubcard pricing integration, and mobile-friendly layout, but lacks critical subscription/auto-delivery features and modern express checkout options that pet-focused competitors are leveraging for customer retention.

Performance by Criteria

Competitive Advantages

- Mobile-optimized interface with excellent touch-friendly controls, meeting accessibility guidelines and providing smooth mobile experience (critical for 65%+ mobile traffic in UK market)

- Clear product information with pack size prominence, Clubcard Price integration, and unit pricing that addresses pet food confusion around weight/size

- Intuitive quantity editing with immediate visual feedback and well-designed +/- buttons that reduce friction in basket management

Vulnerabilities

- Zero subscription functionality for pet food category

- No express checkout options on basket page

- Delivery costs hidden until slot booking, no progress indicator for £25 minimum basket threshold

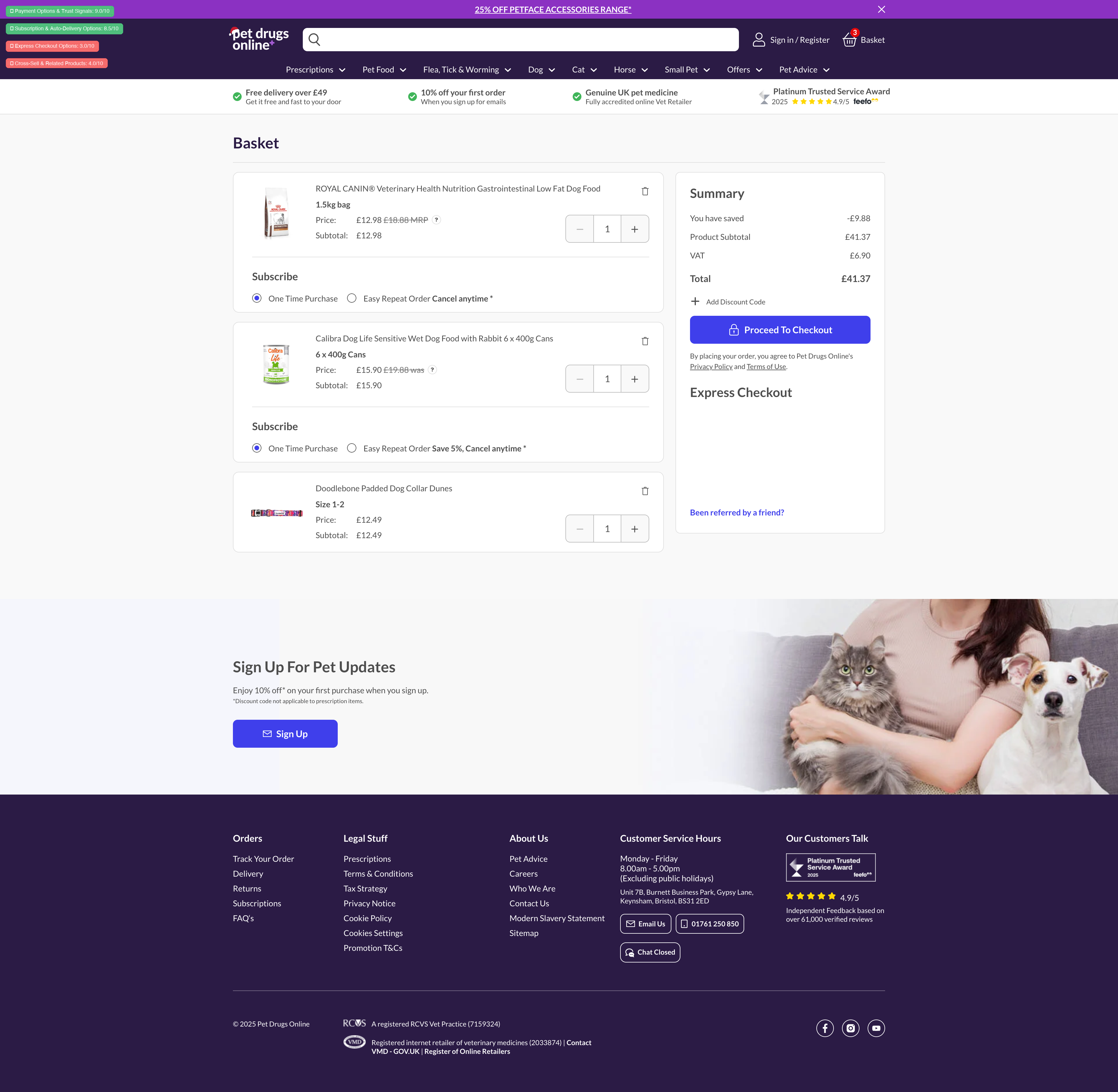

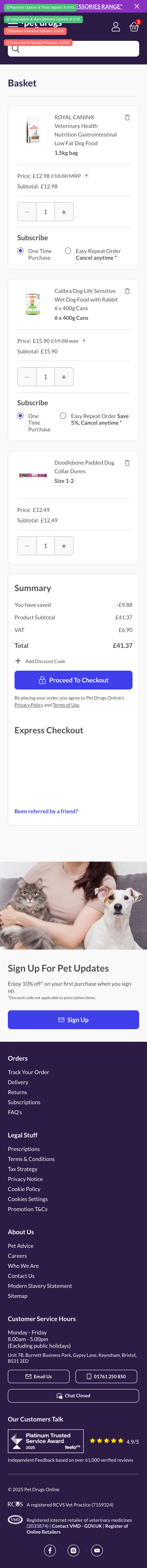

Pet Drugs Online demonstrates strong fundamentals with subscription integration and clear basket structure, but lacks modern express checkout options and has limited delivery urgency indicators that could impact conversion.

Performance by Criteria

Competitive Advantages

- Comprehensive subscription implementation with inline switching, clear savings percentages, and 'Cancel anytime' messaging addresses key pet food consumer needs and drives recurring revenue

- Exceptional trust signal deployment including Platinum Trusted Service Award (4.9/5 from 61,000+ reviews), RCVS veterinary accreditation, and prominent customer service contact information

- Strong product detail presentation with prominent pack size information (critical for pet food), clear product images, and intuitive +/- quantity adjustment buttons

Vulnerabilities

- Non-functional express checkout section leaves 30-50% conversion uplift opportunity on table

- No delivery date visibility or urgency messaging in basket creates uncertainty

- Complete absence of basket-level cross-sell leaves 35% revenue opportunity untapped

VioVet demonstrates solid fundamentals with clear pricing transparency and PayPal integration, but lacks modern convenience features like subscription options and express checkout that market leaders now offer. Their basket UX is functional but not differentiated.

Performance by Criteria

Competitive Advantages

- Excellent free delivery threshold transparency with clear £35 messaging and FREE delivery status prominently displayed in basket summary

- Robust 'Save for Later' functionality providing customer flexibility to manage purchase timing without losing items

- Strong cross-sell implementation with contextual 'Customers Also Bought' recommendations including social proof (reviews/ratings) and frictionless add-to-basket

Vulnerabilities

- Zero subscription functionality for high-frequency repeat purchase items like dog food

- No specific delivery timeframes or urgency messaging in basket

- Missing Apple Pay and Google Pay express checkout options despite strong mobile traffic

Lords & Labradors demonstrates strong fundamentals in cart experience with clear pricing and trust signals, but lacks critical subscription/auto-delivery functionality that pet food specialists are leveraging for customer retention and LTV optimization.

Performance by Criteria

Competitive Advantages

- Comprehensive payment options and prominent trust signals (9.0/10) create strong conversion foundation with security messaging, return policy visibility, and 10+ payment methods reducing friction

- Clear free delivery threshold communication (8.5/10) immediately shows qualification status, addressing primary abandonment concern about unexpected shipping costs

- Intuitive quantity editing with +/- buttons (8.5/10) and clear remove options provide friction-free basket management aligned with industry best practices

Vulnerabilities

- No subscription or auto-delivery options for consumable pet food products

- Generic product recommendations not contextualized to basket contents or customer behavior

- Vague delivery timeframes without specific dates or urgency messaging

Pets Corner demonstrates solid basket page fundamentals with clear delivery thresholds and well-structured summary, but lacks critical subscription functionality and express checkout options that market leaders leverage for repeat purchase conversion.

Performance by Criteria

Competitive Advantages

- Exceptional dual-threshold delivery cost transparency (£30 Royal Mail, £59 Next Day) with specific gap messaging drives basket value and eliminates shipping surprise abandonment

- Strong delivery timing and urgency communication ('available for delivery tomorrow', specific upgrade cost remaining) reduces purchase anxiety and encourages conversion

- Effective cross-sell recommendations with Christmas seasonal merchandising and easy add-to-basket functionality increases average order value

Vulnerabilities

- Zero subscription or auto-delivery capability visible on basket page for consumable pet food products

- No express checkout options (Apple Pay, Google Pay, PayPal) on basket page despite high mobile traffic

- Pack size/weight information not prominently displayed as separate element, embedded only in product title text

Solid mid-market execution with clear delivery threshold messaging and loyalty integration, but missing critical subscription functionality and express checkout options that market leaders leverage for conversion.

Performance by Criteria

Competitive Advantages

- Free delivery threshold communication is exceptional - dual messaging (progress bar + numeric gap) creates clear urgency and motivation to add items, directly addressing the #1 abandonment reason

- Pooch Rewards loyalty integration is prominent in basket (26 points messaging) - drives repeat purchase behavior and demonstrates points value at moment of decision, competitive advantage in retention

- Quantity editing UX is polished and intuitive with large touch-friendly +/- buttons and clear remove options, reducing friction in basket modification

Vulnerabilities

- No subscription functionality integrated into basket experience despite consumable products

- Absence of express checkout buttons (Apple Pay, Google Pay) on basket page

- Vague delivery timing (1-5 working days) creates uncertainty without specific dates

Petplanet demonstrates solid fundamentals with express checkout and mobile optimization, but lacks critical subscription features and shipping transparency that market leaders leverage for retention and conversion.

Performance by Criteria

Competitive Advantages

- Excellent mobile optimization with large touch targets, readable text, and sticky CTA - competitive with market leaders in mobile-first execution

- Strong express checkout integration (PayPal, Google Pay) positioned prominently with proper brand styling - reduces friction for repeat customers

- Product details in cart are comprehensive with critical pack size information prominently displayed - addresses key pet food category requirement

Vulnerabilities

- Zero subscription or auto-delivery functionality visible in basket flow

- No free shipping progress indicator or shipping cost visibility on basket page

- Complete absence of delivery time estimates and urgency messaging