Competitive Intelligence Report

Product Page Analysis | Generated 2025-11-21 11:48:17

Executive Summary

2

Competitors Analyzed

7.3

Average Score

7.8

Top Score (ASOS)

6.8

Lowest (Zara)

Key Insights

- 🏆 Market Leader: ASOS leads with 7.8/10

- 📊 Most Consistent: ASOS shows the most balanced performance

- 💪 Industry Strength: Product Imagery & Gallery (avg: 8.5/10)

- ⚠️ Market Vulnerability: Subscription/Auto-Delivery Options (avg: 1.5/10) - opportunity to differentiate

Visual Analysis

Filter & Search

0.0/10

Showing 2 competitors

Competitor Profiles

ASOS

https://www.asos.com/

7.8/10

Strong Contender

ASOS demonstrates strong execution of e-commerce fundamentals with particular strength in visual presentation and mobile optimization, though they show vulnerabilities in social proof implementation and subscription offerings that present clear differentiation opportunities.

Performance by Criteria

Product Imagery & Gallery

advantage

8.5

Add to Basket/Cart Prominence

advantage

9.0

Pricing & Offer Transparency

advantage

8.0

Product Information Completeness

parity

7.5

Reviews & Social Proof

vulnerability

4.5

Subscription/Auto-Delivery Options

parity

3.0

Delivery & Fulfillment Options

parity

8.5

Trust & Security Indicators

parity

7.0

Cross-sell & Upsell Effectiveness

advantage

8.0

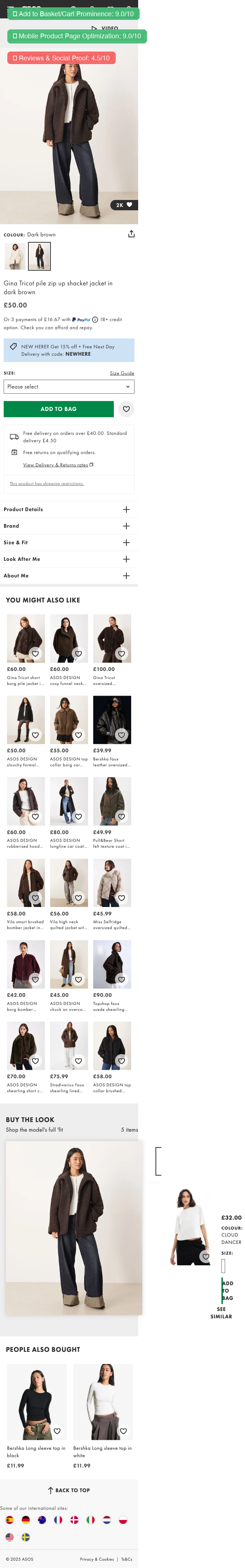

Mobile Product Page Optimization

advantage

9.0

Competitive Advantages

- Exceptional mobile-first design with sticky CTA, optimized touch targets, and sophisticated navigation that sets a high bar for mobile commerce experiences

- Superior visual merchandising system combining multiple high-quality images, video content, and model views that effectively showcases products and reduces purchase uncertainty

- Highly prominent and optimized 'Add to Bag' CTA with excellent color contrast and positioning that removes friction from the purchase path

Vulnerabilities

- Zero visible customer review integration on product pages despite industry research showing 95% of users read reviews and 58% won't buy without them

- No specific delivery date estimates shown on product page, only generic 'next day' promotional messaging

- Key product specifications hidden behind accordion/expandable sections, not immediately visible above fold

Desktop

Mobile

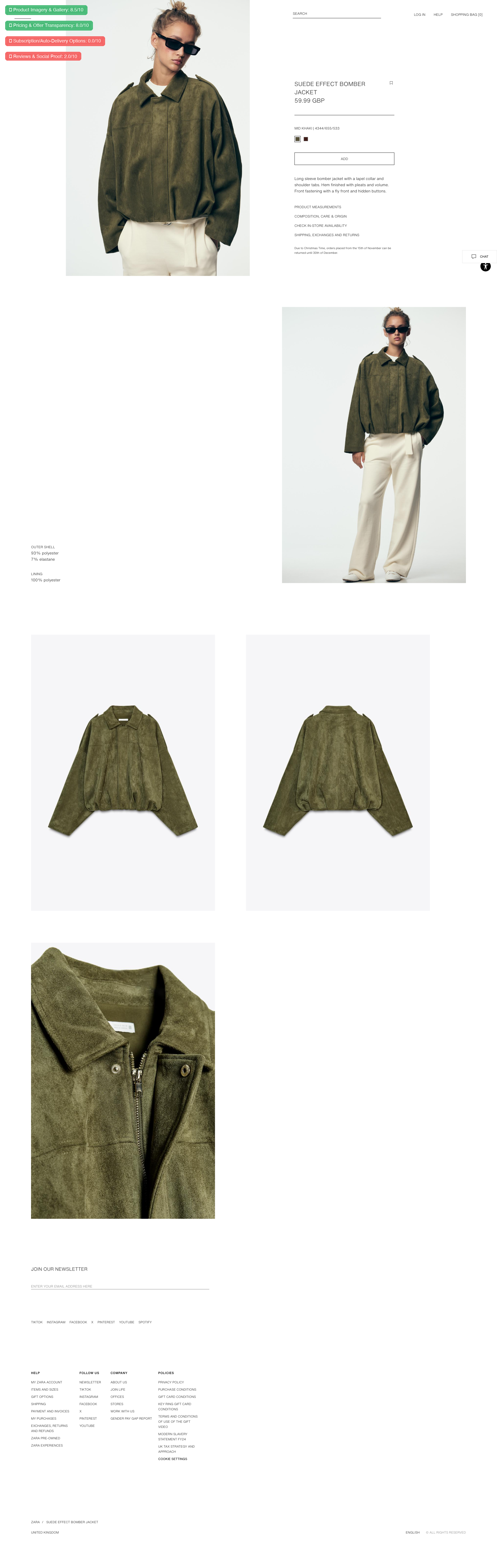

Zara

https://www.zara.com/

6.8/10

Strong Contender

Zara demonstrates strong visual merchandising with high-quality imagery and clean aesthetic, but exhibits significant vulnerabilities in social proof, subscription options, and delivery transparency that create exploitable gaps.

Performance by Criteria

Product Imagery & Gallery

advantage

8.5

Add to Basket/Cart Prominence

parity

7.0

Pricing & Offer Transparency

advantage

8.0

Product Information Completeness

advantage

7.5

Reviews & Social Proof

vulnerability

2.0

Subscription/Auto-Delivery Options

vulnerability

0.0

Delivery & Fulfillment Options

vulnerability

4.0

Trust & Security Indicators

parity

6.5

Cross-sell & Upsell Effectiveness

parity

7.0

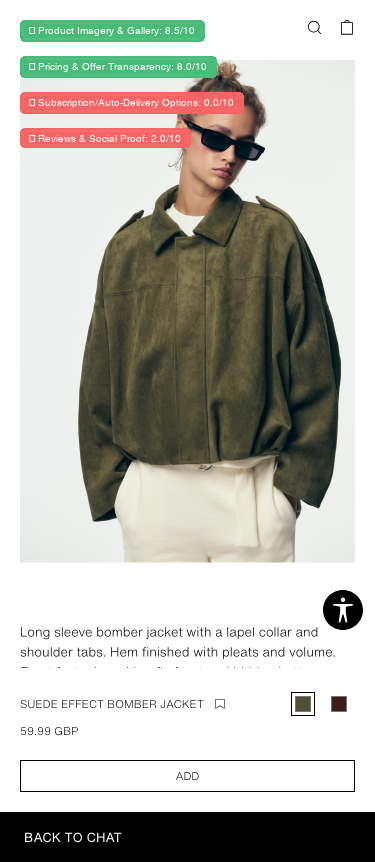

Mobile Product Page Optimization

advantage

8.0

Competitive Advantages

- Exceptional product photography with multiple high-resolution images including lifestyle, flat lay, and detail shots that create strong visual merchandising and emotional connection

- Clean, minimalist interface design that reduces cognitive load and emphasizes product while maintaining brand luxury positioning across both mobile and desktop

- Clear pricing transparency without hidden costs or confusing promotional structures that builds trust and reduces cart abandonment risk

Vulnerabilities

- Zero social proof or customer review integration on product pages

- Delivery information hidden or insufficiently prominent in purchase flow

- No subscription or loyalty program integration visible in product experience

Desktop

Mobile